Best Personal Finance & Budgeting Apps For Your Smartphone

Managing household budgets revolves around a conclusive plan. There should be discipline, keen awareness of money spent, impulse control and diligent tracking of your income and expenses. Whether you own a business, work for a paycheck or manage a household, keeping track of expenses every month can be a daunting task. However, you can stay on top of your finances on the go thanks to some expense tracking apps. You can manually enter your incoming and outgoing transactions on the get go. To make it easier for the high-flyer or the common middle man to control income and expenditure, there are some cool Apps for Android and iOS Smartphone users.

• BUDGT - It has a clean visual design and is one of the best lightweight budgeting apps. You can track your expenses with a hard and fast budgeting plan. All you have to do is create and manage your monthly budget plan by entering your categories that are displayed in colorful expense charts. Bold fonts, clean screens and pie charts will make it easy to enter and track your expenses.

• Spendee - An iOS expense and budget app, it features a brightly colored, flat and easily navigable User Interface. You can quickly log into expenses for different categories. There is an option to snap photos of receipts and bills for easy access and storage. You can scroll through your expenses with the Feed tab. The Overview mode offers infographics that lets you view you a breakdown of items and categories on what you are spending money on.

• Expense Manager - It is a expense logging and budgeting app that lets users quickly input expenses and create custom budget categories. In the home page, the app will provide a display of total expenses made for a particular month and specify the amount remaining before it hits the budget cap. There is also the feature to search your history of expenses.

• One Touch Expenser – Lets say you keep an efficient account of your monthly expenses. All you need to do is to set a budget plan and divide into categories like entertainment, healthcare, and then enter than information as reminders and charts that can be tracked over time. There are some helpful widgets to help you enter expenses, set reminders for particular expenses like utilities and bills and photograph receipts to file later.

• Toshl Finance – It is a one-of-a-kind budget tracker that has cute, cartoonish monsters to set your budget plan and track your expenses. After creating an account, a customized budget can be created for just one-time or for daily, weekly, monthly and yearly periods. You can export expense reports, enter expenses quickly, and repeat expenses for bills. This app makes for a powerful but simple expense logging tool. The data also syncs to your account, which makes to easier for you to manage your money across various other devices.

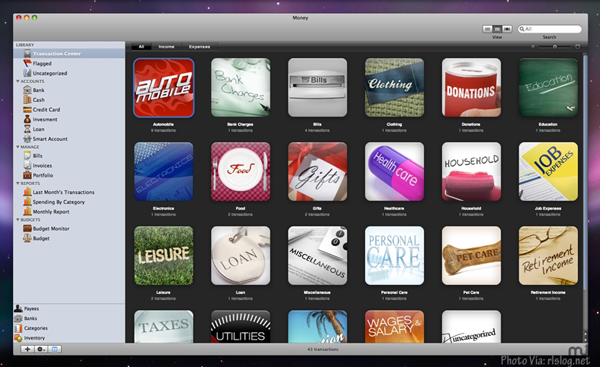

• Money by Jumsoft - It is designed to sync with desktop apps. It makes for a great money management, standalone budget app for Smartphones. You can input repeating expenses, set a budget, divide and categorize expenses and also track the bits and pieces of your budget easily. Multiple budgets with variable periods can also be created with easy-to-understand infographics and ability to work with multiple currencies.

• MoneyWise – It is a free budget tracking app that lets users create and edit various budgets with customizable periods for income and expense entries. You can define payment periods, set repeating expenses and get a bird’s eye view of the state of your budget plan with infographics. The app also works offline while letting you export data to cloud storage or email.

• Intuit’s Mint Personal Finance – Lets say you track your financial state as a whole. Apart from providing expense logging and in-depth personal budget management, the app allows users to sync their card and bank details for a secure and up-to-date look at their financial stand.

• Concur – It is an app that lets you record, sort and keep track of official business travel expenses. This removes the pain of creating expense reports. You can plan trips, photograph bills, record expenses, enter hotel charges and approve or submit reports for expenses.